In the wake of The Great Recession, as Americans were lashing out at banks that were “too big to fail” and young people started “Occupying” Wall Street, Congress set in motion banking regulations designed to turn the industry on its ear. While some of the initial proposals of the now-famous Dodd-Frank legislation didn’t quite make it to the end, hundreds of regulations did, with more being rolled out all the time.

In the third quarter of 2014 alone, almost 100 new regulations hit the books, increasing compliance demand on banks by 26 percent according to data from the Banking Compliance Index (BCI).

Examples of Compliance Changes

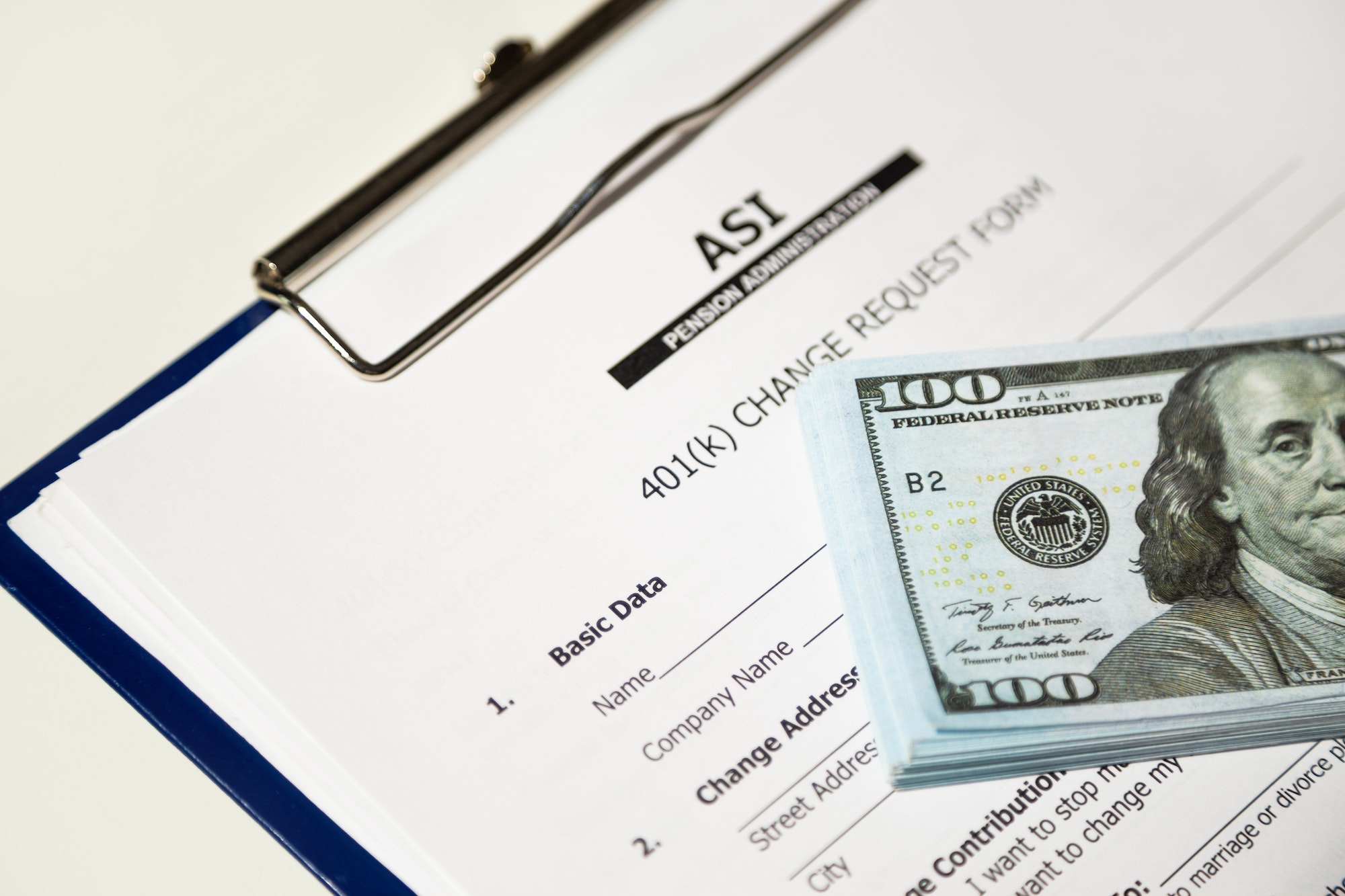

A major component of the Dodd-Frank regulations will take effect this year, the Small Business Loan Data Collection subset of the Equal Credit Opportunity Act. The new rules state that banks must collect and report data regarding credit applications of minority and women-owned businesses, as well as small businesses. The language in the regulation states that its purpose is to “facilitate enforcement of fair lending laws and enable communities, governmental entities and creditors to identify business and community development needs and opportunities of women-owned, minority-owned, and small business.”

Banks will need to collect, report, act upon, and save specific sets of information in new ways based upon this rule. That means that their systems must meet specific requirements on everything from structure to storage.

How Banks Are Managing Compliance Changes

While financial institutions bristled and braced themselves for sweeping change, something interesting has been happening in the industry. Bankers are becoming more tolerant of regulation, and they are better prepared to respond to rapid changes in oversight and compliance.

Part of the reason why banks are absorbing change so well, according to the BCI, is better compliance infrastructure. IT systems that are scalable and nimble ensure that financial institutions can respond quickly to new rules, without jeopardizing compliance or the security of their data.

To remain nimble, financial institutions are spending more time and more resources recruiting talent at all levels of banking compliance and security, but more specifically, they are on the hunt for tech talent. They are utilizing data not only to remain complaint, but to make decisions that are helping them remain nimble in the marketplace. They rely on technology to help maximize profits and minimize expenses, to mitigate against the increased cost of compliance and security.

If your South Florida banking, finance or financial services organization is looking for innovative ways to recruit and retain talented IT employees for compliance, CERS can help. We are a nationally recognized recruiting and consulting firm based in the Miami area that works with companies to help them develop and execute strategic hiring processes. If you want to stay ahead of compliance changes in 2015, contact the team at CERS today.